Bank App Investment Feature

Enterprise UX • UX strategy • Financial services • Behavioural design • Personalisation • Data visualisation

Objective

This investment feature was underutilised within HSBC’s mobile app. Customers saw the feature but rarely engaged. The challenge was about building confidence, trust, and usability in digital wealth management.

Target audience

HSBC retail banking customers with moderate investment experience, including busy professionals seeking automated portfolio guidance.

Business goals

Increase engagement and adoption of HSBC’s investment services among the mass-affluent segment.

Strengthen the bank’s position in digital wealth management by offering a differentiated, scalable experience.

Validate a proof of concept that could inform future global rollout.

User goals

Make digital investing simple, transparent, and trustworthy for users intimidated by financial complexity.

Build confidence through personalised, guided experiences that help users understand and control their investments.

Remove friction points that prevent users from exploring or completing an investment journey.

Roll & Responsibilities

Role: Senior UX Designer

Responsibilities: Led end-to-end UX activities including framing the problem space, running user research activities, persona development, journey mapping, design strategy, high-fidelity prototyping, and coordination with the business and engineering teams.

Team: Product owners and managers, tech lead, compliance, user research, data analysts, and design system representatives.

Problem statement

How might we redesign an investment feature for HSBC’s customers so that they feel confident engaging with digital discretionary investments, minimising cognitive load, building trust and encouraging discovery, while working within existing technical constraints, knowledge gaps, and a tight delivery timeline?

Research

Methodology

We ran qualitative research (interviews) with a mix of internal business and beginner and intermediate investors, plus competitive analysis and benchmarking.

Synthesised insights into behavioural personas and mapped needs to HSBC’s business objectives.

Key findings

Discoverability gap

Users saw the feature but skipped it, because of unclear value and their mindset was transactional, not exploratory.

Mismatch in needs

Active traders compared HSBC to tools like Interactive Brokers or Futu HK, preferring more granular control.

Transparency vs complexity

Beginners found fees opaque, language complex, and portfolios hidden in PDFs.

Segmenting user needs

Novice users sought hand-holding and reassurance, experienced users wanted visual clarity and control.

Framing ambiguity to clarity:

Make the feature discoverable and relevant in context.

Reduce friction and intimidation by simplifying decision-making.

Ideation

Approach

With ambiguity defined, I led workshops to explore possible design directions and mapped user journeys. We prioritised ideas into three focus areas:

Personalisation

Dynamic greetings and recommendations based on user profile.

“What-if” investment simulators driven by Quantifeed APIs.

Tailored education content surfaced in context.

Transparency

Unified fee breakdown shown upfront.

Portfolio projections presented visually, not in text-heavy PDFs.

Clear onboarding with fewer steps, fewer unknowns.

Confidence cues

Reinforced trust with plain language copy and visual consistency.

Contextual nudges (e.g. rebalancing notifications) positioned as proactive support, not pressure.

Brand voice used sparingly to reassure, without overwhelming users.

User-journey

Design iteration

We had dozens of concepts, I prioritised these down to what mattered most:

Simplicity, clarity, and confidence.

We deliberately cut features like education libraries (saved as future ideas), to keep the feature focused and achievable within the timeframe.

Design

The design phase was about execution with clarity and intent.

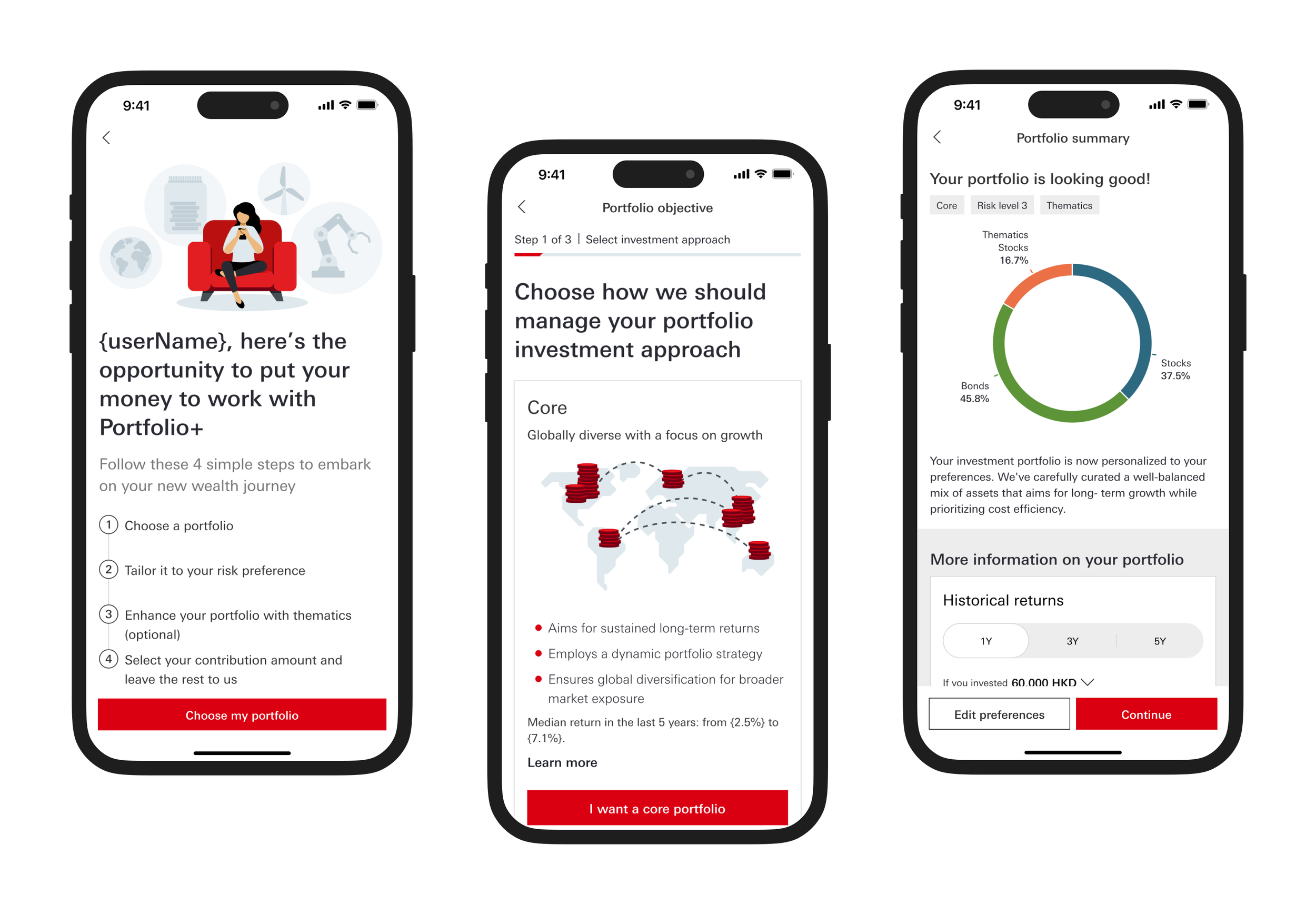

Onboarding flow

Reduced steps significantly by collapsing redundant screens, simplifying content and adding progressive disclosure.

Portfolio sumulator

Allowed users to adjust inputs (time horizon, risk appetite) and see potential outcomes instantly.

Dashboard redesign

Colour-coded allocations, interactive performance recaps, and gain/loss summaries.

Fee transparency

Visualised costs as a single, clear number with contextual explainer.

Guided onboarding

Portfolio

Portfolio analysis

Error states

Everything was designed with one question in mind.

Does this reduce friction and build confidence? If not, it was deprioritised.

User testing

Approach

Format

1-hour moderated, one-on-one prototype testing sessions via Zoom.

Methodology

Qualitative research using an interactive prototype.

Duration

1 week

Participants

Total participants

9 people.

Age range

25-50 (majority in their 30s).

Investor experience

4 beginner investors, 5 intermediate investors.

Customer segments

Primarily HSBC One customers, with some Premier customers.

Digital familiarity

All participants familiar with digital investment tools; some had not previously used robo-advisors.

Demographic insight

The group largely represented mass affluent individuals with a strong preference for digital wealth management solutions.

Findings

Users responded well to clarity in fees and said it made them “trust the product more.”

Portfolio simulators increased confidence, “This is the first time I’ve understood what my money would actually do.”

Drop-offs highlighted in review screens led to reducing steps and improving visual hierarchy.

Error states caused confusion, we redesigned them to explain why errors occurred and how to resolve them.

Feedback integration

Reduced decision steps significantly after observing drop-off at investment review screen.

Revised fee explanation screens with visual aids based on confusion during testing.

Iterated visual hierarchy and interaction microcopy to reinforce user confidence.

Impact

Engagement

Internal UAT showed an increase in feature interaction against baseline.

Efficiency

Decision steps reduced significantly, cutting friction in critical user journeys.

Trust

Qualitative feedback indicated a significant boost in perceived confidence and transparency.

Strategic fit

Established design patterns scalable for future HSBC digital wealth products.

Learnings

Navigating ambiguity

This project started vague “fix adoption”, but through research and prioritisation, we reframed it into a clear, user-centered problem.

Prioritisation

Good design is as much about what you remove as what you add. Prioritisation was a key principle to success.

Assumed knowledge

Design decisions must be explicit and backed by user insights.

Product lens

Thinking beyond screens, I aligned the design to HSBC’s long-term digital wealth strategy.

Conclusion

The feature wasn’t just a redesign, it was a shift from confusion to confidence. By focusing on personalisation, transparency, and trust, we created a digital experience that made investing approachable, scalable, and aligned to both user and business goals.

For users, it transformed uncertainty into clarity, helping them make informed decisions with ease. For HSBC, it proved that simplifying complexity and designing for trust drives measurable engagement and business value.

For me, it reinforced a core belief, in complex, regulated spaces, design’s real job is to simplify, clarify, and curate, building confidence where there was once hesitation.

This project reaffirmed a core principle I carry into every engagement: